In this manner, your credit score will be modified by the credit reference agencies.Ī defaulted account means you cannot keep up with the agreed payments. However, once your account is in default this can be registered in your credit files which can greatly affect your credit. The notice itself does not harm your credit rating.

Does a default notice harm my credit rating? These debts include store cards, credit cards, overdrafts, personal loans, and HPA.

This only applies to debt regulated by the Consumer Credit Act. This is usually sent when you pay less then the amount agreed within 3 to six months period. If you can bring your account up to date, your account will not default. You will have at least 2 weeks to settle your arrears. This serves as a warning that your account will soon default if you failed to secure payments.

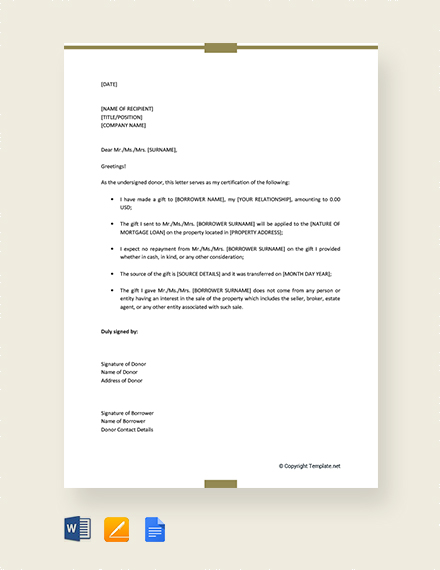

Default Notice ExplainedĪ notice of default is a letter from your creditor. You may also read our guide: Financial Help Available During Coronavirus Pandemic and Payments for Car Loans and Finance During Coronavirus Outbreak. These include payment breaks on mortgage and payment holidays for some unsecured debts and moratorium extension for residents in Scotland. Several measures are considered to assist individuals who are coping with the effects of COVID-19 or Coronavirus Pandemic to their finances. You may read our post if creditors can force you to pay your debt.įinancial Help During COVID-19 Pandemic and Default Notices Though your debt can only default once, your creditor can take further steps to recover the debt. You must remain compliant with the terms of your agreement otherwise, your creditor will terminate your agreement. Thus, it can affect your credit record, making it hard for you to secure debts in the future. Once your creditor puts your account in default, this will be registered in your credit file. This is referred to as a notice of default. You may get a default notice from your creditors once you missed payments, or fail to pay the agreed amount. This debt advice applies to individuals in the UK with personal debts.

0 kommentar(er)

0 kommentar(er)